Shopping for car insurance can be overwhelming, especially when you live in Washington state. With so many insurance providers and coverage options available, finding the right policy for your budget and needs can be a challenge. That’s why it’s essential to compare car insurance quotes in WA to ensure you get the right coverage at a competitive price. In this article, we’ll guide you through the process of getting car insurance quotes in WA, so you can choose the best policy for your situation.

Discover the Most Affordable Car Insurance in WA: Top Providers Compared”.

If you are a driver in Washington State, having car insurance is mandatory. However, that doesn’t mean you have to spend a lot of money to get adequate coverage. In this article, we will compare some of the top car insurance providers in Washington to help you find the most affordable option for your needs.

Factors that Affect Car Insurance Rates in WA

Before we dive into the providers, it’s important to understand what factors can affect your car insurance rates in Washington. These can include:

- Driving record: A history of accidents or traffic violations can increase your rates.

- Age: Younger drivers typically pay more for insurance than older, more experienced drivers.

- Location: Where you live can impact your rates. Urban areas and areas with high rates of accidents or theft may have higher rates.

- Type of car: More expensive or high-performance cars can be more expensive to insure.

- Credit score: In Washington, insurance companies can use your credit score to determine your rates.

Top Car Insurance Providers in WA

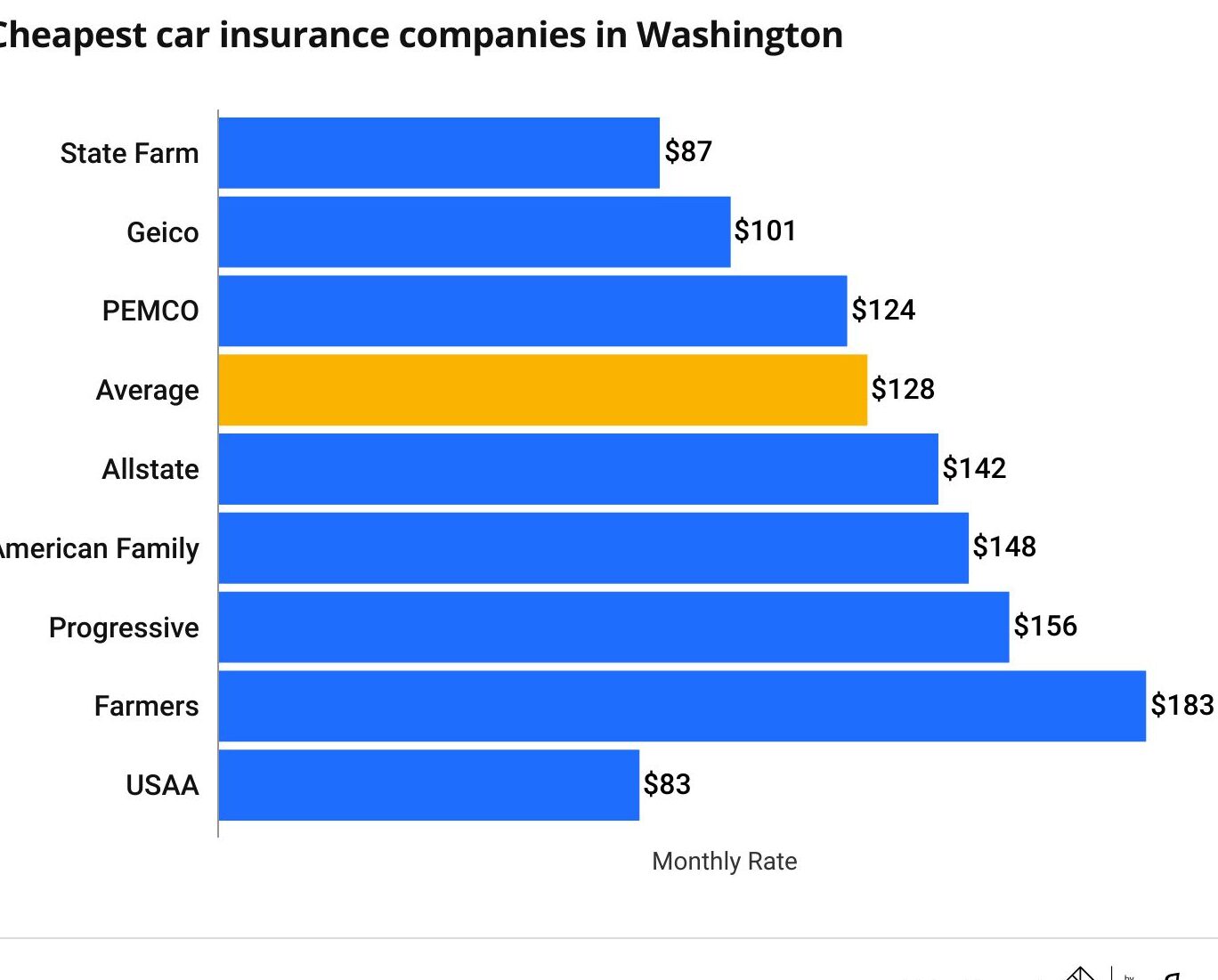

Now, let’s take a look at some of the top car insurance providers in Washington and compare their rates and coverage options.

State Farm

- Cost: State Farm is often one of the more affordable options for car insurance in Washington.

- Coverage: State Farm offers a wide range of coverage options, including liability, collision, and comprehensive coverage.

- Discounts: State Farm offers a variety of discounts, including multi-car, safe driving, and good student discounts.

Geico

- Cost: Geico is known for offering low rates for car insurance in Washington.

- Coverage: Geico offers standard coverage options, as well as additional options like mechanical breakdown coverage.

- Discounts: Geico offers a variety of discounts, including safe driving, good student, and federal employee discounts.

Progressive

- Cost: Progressive’s rates can vary depending on the driver’s location and driving record, but they do offer competitive rates in Washington.

- Coverage: Progressive offers a range of coverage options, including liability, collision, and comprehensive coverage.

- Discounts: Progressive offers a variety of discounts, including multi-car, online quote, and good student discounts.

Liberty Mutual

- Cost: Liberty Mutual’s rates can be on the higher side compared to other providers in Washington.

- Coverage: Liberty Mutual offers standard coverage options, as well as additional options like new car replacement coverage.

- Discounts: Liberty Mutual offers a variety of discounts, including multi-policy, safe driving, and hybrid vehicle discounts.

The Ultimate Guide to Finding the Cheapest Car Insurance

If you’re looking for car insurance quotes in WA, you’re probably aware that car insurance can be expensive. However, finding affordable car insurance is possible with the right information and some effort. Here’s what you need to know:

Factors that Affect Car Insurance Rates

Car insurance companies use a variety of factors to determine your car insurance rates. These factors may include:

- Your driving record: If you have a history of accidents or traffic violations, you may pay more for car insurance.

- Your age and gender: Younger drivers and male drivers typically pay more for car insurance.

- Your location: If you live in an area with high rates of car theft or accidents, you may pay more for car insurance.

- Your car: The make and model of your car can affect your car insurance rates. Cars that are expensive to repair or more likely to be stolen may cost more to insure.

- Your coverage options: The amount of coverage you choose can affect your car insurance rates.

Types of Car Insurance Coverage

There are several types of car insurance coverage you can choose from. These include:

- Liability coverage: This type of coverage pays for damages you cause to another person or their property.

- Collision coverage: This type of coverage pays for damages to your own car if you’re in an accident.

- Comprehensive coverage: This type of coverage pays for damages to your car that are not caused by a collision, such as theft, vandalism, or natural disasters.

- Personal injury protection: This type of coverage pays for medical expenses if you or your passengers are injured in an accident.

Ways to Save on Car Insurance

There are several ways you can save on car insurance, including:

- Shop around: Get quotes from multiple car insurance companies to find the best rates.

- Bundle your insurance: If you have multiple insurance policies, such as home and auto insurance, you may be able to save by bundling them with the same company.

- Take advantage of discounts: Car insurance companies offer a variety of discounts, such as safe driver discounts, multi-car discounts, and good student discounts.

- Choose higher deductibles: A higher deductible can lower your car insurance rates, but make sure you can afford to pay the deductible if you need to make a claim.

By understanding the factors that affect car insurance rates, choosing the right coverage options, and taking advantage of discounts and other savings opportunities, you can find affordable car insurance in WA.

Decoding Washington’s Average Car Insurance Costs: What You Need to Know

If you’re a driver in Washington State, it’s important to understand the average car insurance costs in your area. Knowing this information can help you make informed decisions when shopping for car insurance quotes WA.

Factors that Affect Car Insurance Rates in Washington State

Car insurance rates in Washington State are affected by a variety of factors, including:

- Your driving record

- Your age and gender

- The type of car you drive

- Where you live

- Your credit score

- Your coverage limits

Each of these factors can have a significant impact on the cost of your car insurance premiums.

Washington State Car Insurance Requirements

In Washington State, drivers are required to carry liability insurance to cover any damages or injuries they may cause in an accident. The minimum liability insurance requirements in Washington State are:

- $25,000 for bodily injury or death of one person in an accident

- $50,000 for bodily injury or death of two or more people in an accident

- $10,000 for property damage in an accident

It’s important to note that these are just the minimum requirements. You may want to consider purchasing additional coverage to protect yourself and your vehicle in the event of an accident.

Average Car Insurance Costs in Washington State

According to a recent study, the average car insurance premium in Washington State is $1,202 per year. However, this can vary depending on where you live in the state. For example, drivers in Seattle may pay more for car insurance than drivers in Spokane.

How to Get the Best Car Insurance Rates in Washington State

If you’re looking for the best car insurance rates in Washington State, there are a few things you can do:

- Compare quotes from multiple insurance companies

- Take advantage of discounts

- Consider raising your deductible

- Maintain a good driving record

By following these tips, you can help ensure that you’re getting the best car insurance rates possible.

The Ultimate Guide to Finding Cheap Car Insurance in Australia

If you own a car in Australia, having car insurance is mandatory. However, finding cheap car insurance that meets your needs can be challenging. Here is a guide to help you find affordable car insurance in Australia.

1. Compare Car Insurance Quotes

Comparing car insurance quotes from different providers is the best way to find cheap car insurance. It is essential to compare the features and benefits of the policies, as well as the cost of each policy.

Factors that affect car insurance quotes in WA:

- Your age, gender, and driving experience

- The make and model of your car

- Your location and where the car is parked

- Your driving record and claims history

- The level of coverage you choose

2. Choose the Right Level of Coverage

There are three levels of car insurance coverage in Australia:

- Compulsory Third Party (CTP) Insurance: This is the minimum level of car insurance coverage required by law in Australia. CTP insurance provides coverage for injuries or death caused to other people in an accident.

- Third-Party Property Insurance: This type of insurance covers damage caused to other people’s property or cars.

- Comprehensive Insurance: This is the highest level of car insurance coverage available. It covers damage caused to your car, as well as damage caused to other people’s property or cars.

3. Consider Additional Coverage

In addition to the standard coverage, some car insurance providers offer additional coverage options. These options may include:

- Roadside assistance

- Hire car coverage

- Windscreen coverage

- No claim bonus protection

4. Check for Discounts

Car insurance providers offer various discounts that can help you save money on your car insurance premiums. Some common discounts include:

- No claims bonus

- Multi-car discount

- Online purchase discount

- Paying annually instead of monthly

5. Read the Fine Print

Before you sign up for car insurance, it’s important to read the fine print and understand the terms and conditions of the policy. Pay attention to details such as excess, exclusions, and limits.

By following these steps, you can find cheap car insurance in Australia that meets your needs and budget.

My final tip for you when shopping for car insurance quotes in WA is to always compare multiple quotes before making a decision. This will help you to find the policy that fits your needs and your budget. Don’t be afraid to ask questions and clarify any doubts you may have with your insurance provider.

Thank you for taking the time to read this article and for considering the importance of having the right car insurance policy. Remember that your safety and financial protection are worth the investment. Drive safely!

If you found this article informative and engaging, be sure to visit our Auto insurance section for more insightful articles like this one. Whether you’re a seasoned insurance enthusiast or just beginning to delve into the topic, there’s always something new to discover in topbrokerstrade.com. See you there!