As a small business owner, protecting your business and assets is crucial for its success. One of the best ways to do this is by investing in a comprehensive small business insurance policy. However, finding the right insurance provider and policy can be overwhelming and confusing. This is where Youi Small Business Insurance comes in. With their tailored insurance solutions, Youi can help protect your business against unexpected events and give you the peace of mind you need to focus on growing your business. In this article, we’ll take a closer look at the benefits of Youi Small Business Insurance and how it can help safeguard your business.

The Ultimate Guide to Youi Insurance’s Parent Company: Everything You Need to Know

Youi Insurance is a well-known insurance provider that offers a variety of insurance options, including small business insurance. However, not many people are aware of the company’s parent company, OUTsurance Holdings Limited.

Who is OUTsurance Holdings Limited?

OUTsurance Holdings Limited is a leading insurance company based in South Africa. The company was founded in 1998 and has grown to become one of the largest insurance providers in the country. OUTsurance offers a wide range of insurance products, including car, home, life, and business insurance.

What is the relationship between Youi Insurance and OUTsurance Holdings Limited?

Youi Insurance is a subsidiary of OUTsurance Holdings Limited. In 2019, OUTsurance acquired Youi Insurance, which helped the company expand its reach beyond South Africa. Youi Insurance operates independently, but it benefits from the financial strength and stability of OUTsurance Holdings Limited.

What are the benefits of choosing Youi Insurance as a small business owner?

As a small business owner, choosing Youi Insurance has several benefits, including:

- Customizable coverage: Youi Insurance offers customizable coverage options that allow you to tailor your insurance policy to meet the unique needs of your business.

- Competitive pricing: Youi Insurance offers competitive pricing for its small business insurance policies, which can help you save money.

- 24/7 customer support: Youi Insurance provides 24/7 customer support to help you when you need it most.

- Quick claims processing: Youi Insurance has a streamlined claims process that ensures you get paid quickly in the event of a covered loss.

Discover the Cost of Business Insurance in Australia: A Comprehensive Guide

If you’re a small business owner in Australia, you know how important it is to protect your business from unexpected events. One way to do this is by getting business insurance. However, the cost of business insurance can be a concern for many small business owners. Here’s what you need to know about the cost of business insurance in Australia.

Factors Affecting the Cost of Business Insurance

The cost of business insurance can vary depending on a number of factors:

- Industry: Different industries have different risks, and therefore different insurance costs. For example, a construction company may have higher insurance costs than a consulting firm.

- Size of the business: Larger businesses may have higher insurance costs because they have more assets to protect.

- Type of coverage: The type of coverage you need will also affect the cost of your insurance. For example, general liability insurance will typically cost less than professional liability insurance.

- Location: The location of your business can also affect your insurance costs. Businesses located in areas with higher crime rates or natural disaster risks may have higher insurance costs.

Types of Business Insurance

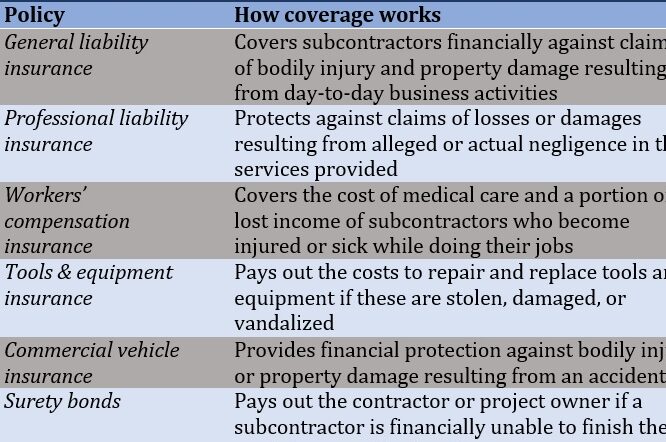

There are several types of business insurance you may want to consider:

- General liability insurance: This type of insurance covers your business for accidents, injuries, and property damage caused by your business.

- Professional liability insurance: Also known as errors and omissions insurance, this type of insurance covers your business if you’re sued for negligence or mistakes in your professional services.

- Property insurance: This type of insurance covers your business property, including buildings, equipment, and inventory, from damage or loss due to theft, fire, or other covered events.

- Workers’ compensation insurance: This type of insurance covers your employees if they’re injured or become ill as a result of their work.

Youi Small Business Insurance

Youi offers small business insurance that’s customizable to meet your specific needs. You can choose from a range of coverage options, including general liability insurance, professional liability insurance, and property insurance. Youi also offers a range of discounts to help you save money on your insurance.

When you get a quote from Youi, you’ll be asked a series of questions to help determine your insurance needs. Youi will then provide you with a quote based on your specific needs.

Understanding the Key Differences Between Business and Private Car Insurance

When it comes to insuring vehicles, there are two main categories: business and private car insurance. While both types of insurance provide coverage for vehicles, there are important differences to consider.

What is Private Car Insurance?

Private car insurance is designed to cover individuals and families who use their vehicles for personal purposes. This type of insurance provides protection against accidents, theft, and damage to the vehicle. Private car insurance policies typically cover the policyholder, as well as any other drivers listed on the policy.

What is Business Car Insurance?

Business car insurance is designed to provide coverage for vehicles that are used for business purposes. This type of insurance is typically required for vehicles that are owned by a business, and it provides protection for the company and its employees. Business car insurance policies typically cover the policyholder and any employees who are authorized to drive the vehicle.

The Key Differences Between Business and Private Car Insurance

Usage

The primary difference between business and private car insurance is the usage of the vehicle. Private car insurance is designed for personal use, while business car insurance is designed for vehicles that are used for business purposes. If a vehicle is used for business purposes, it must be insured under a business car insurance policy.

Coverage

The coverage provided by business and private car insurance policies can also differ. Business car insurance policies typically provide higher levels of coverage than private car insurance policies. This is because business vehicles are typically more expensive and may be used more frequently than personal vehicles.

Premiums

The premiums for business and private car insurance policies can also differ. Business car insurance policies are typically more expensive than private car insurance policies. This is because business vehicles are typically more expensive and may be used more frequently than personal vehicles. Additionally, business car insurance policies may require higher liability limits to protect the company in the event of an accident.

Exclusions

Business car insurance policies may also have exclusions that are not found in private car insurance policies. For example, some business car insurance policies may exclude coverage for vehicles that are used for certain types of business activities, such as racing or delivery services.

Understanding Public Liability Insurance: How Much Coverage Do You Need?

Public liability insurance is a type of insurance that provides protection to businesses and individuals against legal claims for bodily injury or property damage caused to third parties as a result of their business activities.

How much coverage do you need?

Determining the right level of public liability insurance coverage for your business can be a difficult task. Here are some factors to consider:

- Industry: Some industries are riskier than others and may require higher coverage limits.

- Size of your business: Larger businesses may require more coverage since they have more exposure to legal risks.

- Type of clients: Clients with high net worth or high profile may require higher coverage limits.

- Location: Businesses located in areas with higher risk of accidents or crime may require more coverage.

- Level of risk: The nature of your business activities and the likelihood of accidents or incidents should be taken into account to determine the appropriate level of coverage.

It’s important to note that public liability insurance coverage is not a one-size-fits-all solution. Each business has unique needs and risks that should be taken into account when choosing coverage limits.

Benefits of Public Liability Insurance

There are several benefits of having public liability insurance, including:

- Financial protection: Public liability insurance can provide financial protection to businesses against legal claims for bodily injury or property damage caused to third parties.

- Legal defense: The insurance company will provide legal defense in case a claim is made against your business.

- Peace of mind: Having public liability insurance can give business owners peace of mind, knowing that they are protected against potential legal claims.

As we come to the end of this article, I want to leave you with one final tip for small business insurance: always make sure to understand exactly what your policy covers and what it does not. It’s important to take the time to read through your policy documents carefully and ask your insurance provider any questions you may have.

At Youi, we believe in providing personalized insurance solutions that are tailored to meet the unique needs of each small business owner. We understand that every business is different, and we work closely with our clients to ensure that they have the coverage they need to protect their business and their livelihood.

Thank you for taking the time to learn more about Youi small business insurance. If you have any further questions or would like to speak to one of our insurance experts, please don’t hesitate to contact us. We are always here to help.

If you found this article informative and engaging, be sure to visit our Business insurance section for more insightful articles like this one. Whether you’re a seasoned insurance enthusiast or just beginning to delve into the topic, there’s always something new to discover in topbrokerstrade.com. See you there!