If you’re planning a road trip or renting a car for business purposes, it’s essential to have the right insurance coverage. That’s where Sixt Insurance comes in. Sixt Insurance offers a range of products to protect you and your rental car from unexpected events. In this article, we’ll take a closer look at what Sixt Insurance has to offer and how it can benefit you.

Understanding Sixt Car Rental’s Third Party Insurance Policy

If you’re renting a car from Sixt, it’s important to understand their third-party insurance policy. Here’s what you need to know:

What is third-party insurance?

Third-party insurance is a type of car insurance that protects you in the event that you damage someone else’s property or injure someone while driving. If you’re involved in an accident and it’s your fault, your third-party insurance will cover the cost of any damage or injuries that the other party suffers.

What does Sixt’s third-party insurance cover?

Sixt’s third-party insurance covers:

- Damage to third-party property

- Third-party bodily injury

- Death caused by a Sixt rental car

It’s important to note that Sixt’s third-party insurance does not cover damage to the rental car itself. If you want to be covered for damage to the rental car, you’ll need to purchase additional insurance.

What are the limits on Sixt’s third-party insurance?

Sixt’s third-party insurance has limits on the amount that it will cover. These limits vary by country and by the type of rental car that you’re driving. You can find the specific limits for your rental car on Sixt’s website or by contacting their customer service.

What are the exclusions to Sixt’s third-party insurance?

There are several exclusions to Sixt’s third-party insurance policy, including:

- Intentional damage or injury

- Driving under the influence of drugs or alcohol

- Driving without a valid license

- Using the rental car to tow or push other vehicles

- Using the rental car for racing or other illegal activities

If you violate any of these exclusions, Sixt’s third-party insurance will not cover any damage or injuries that you cause.

What should I do if I’m involved in an accident?

If you’re involved in an accident while driving a Sixt rental car, the first thing you should do is make sure that everyone is safe. Call the police and an ambulance if necessary, and exchange insurance information with the other driver. You should also contact Sixt’s customer service as soon as possible to report the accident and get further instructions on what to do.

Understanding Sixt’s third-party insurance policy is an important part of renting a car from them. Make sure you know what’s covered and what’s not before you hit the road.

Unveiling the Truth: Is Sixt Affiliated with NRMA?

When it comes to car rental insurance, customers are always looking for the best options to protect themselves during their rental period. One of the popular options is Sixt insurance, which covers damages and thefts that may occur during the rental period. However, there have been questions about whether Sixt is affiliated with NRMA, and this article aims to unveil the truth behind this claim.

What is NRMA?

NRMA is an Australian-based company that provides roadside assistance, car insurance, and other services related to cars. It is a well-known brand in Australia, and many people trust their services.

Is Sixt Affiliated with NRMA?

The answer is no. Sixt is not affiliated with NRMA. Sixt is a German-based car rental company that operates in many countries worldwide, including Australia. However, Sixt has its own insurance policy that covers damages and thefts that may occur during the rental period.

What does Sixt Insurance Cover?

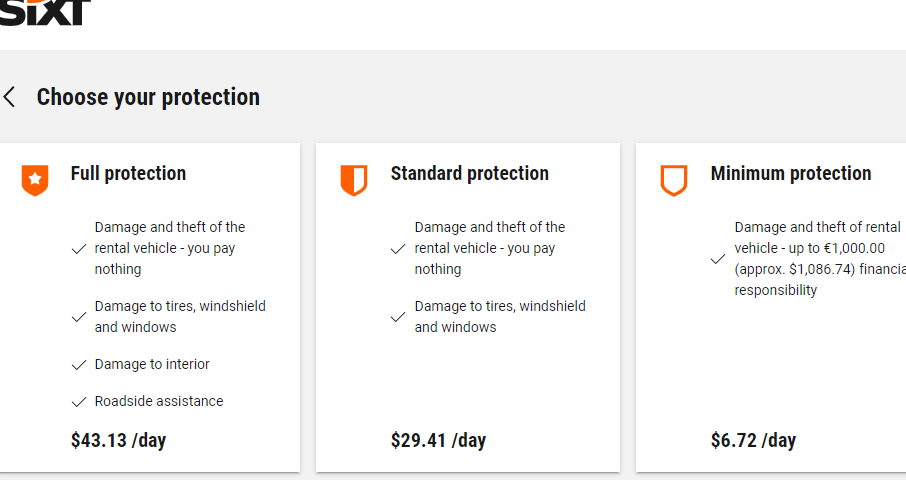

Sixt offers different insurance options to its customers, including:

- Third-Party Liability Insurance: This insurance covers damages or injuries that you may cause to other people or their property while driving the rental car.

- Theft Protection: This insurance covers the theft of the rental car during the rental period.

- Collision Damage Waiver: This insurance covers damages to the rental car that may occur during the rental period. It usually has an excess amount that you need to pay in case of damages.

- Personal Accident Protection: This insurance covers medical expenses and accidental death or disability in case of an accident during the rental period.

Renting a Car in Australia? Here’s Why You Should Consider Rental Car Insurance

Are you planning on renting a car in Australia? It’s a great way to explore the country at your own pace and convenience. However, before hitting the road, it’s important to consider rental car insurance to protect yourself against any unforeseen circumstances.

Why Rental Car Insurance?

When renting a car in Australia, the rental company will typically offer you a basic level of insurance coverage. This coverage may include collision damage waiver (CDW) or loss damage waiver (LDW), which can protect you against damage or theft of the rental car. While this may seem like enough, it’s important to note that these waivers often come with high excess fees, which means you could be liable for a significant amount of money in the event of an accident or theft.

This is where third-party rental car insurance, such as Sixt insurance, can come in handy. These policies can provide you with extra coverage and protection, including coverage for excess fees, which can save you a considerable amount of money in the long run.

What Does Sixt Insurance Cover?

Sixt insurance offers a range of coverage options to suit your needs and budget. These include:

- Collision Damage Waiver (CDW) – Covers damage to the rental car in the event of an accident.

- Theft Protection (TP) – Covers the loss of the rental car due to theft.

- Third Party Liability (TPL) – Covers damage to third-party property and/or injury to third parties in the event of an accident.

- Personal Accident Protection (PAP) – Covers medical expenses and/or death benefits for the driver and passengers in the event of an accident.

Benefits of Sixt Insurance

By choosing Sixt insurance, you can enjoy a range of benefits, including:

- Peace of mind – With Sixt insurance, you can rest assured that you’re fully covered in the event of an accident or theft.

- Affordability – Sixt insurance offers competitive rates, so you can get the coverage you need without breaking the bank.

- Convenience – You can purchase Sixt insurance online or over the phone, making it easy and hassle-free to get the coverage you need.

Understanding Excess Insurance: Is it Necessary for Rental Car Coverage?

If you’re planning to rent a car, you may have noticed that the rental company will offer you different types of insurance. One of these options is excess insurance. But what is excess insurance, and is it necessary for rental car coverage? Let’s take a closer look.

What is Excess Insurance?

Excess insurance is also known as excess reduction or deductible reduction. It’s an optional coverage that reduces the amount you would have to pay in case of an accident or damage to the rental car. If you decline this coverage and the rental car is damaged or stolen, you’ll be responsible for paying the excess amount, which can be as high as $5,000 or more.

How Does Excess Insurance Work?

Excess insurance works by reducing the excess amount you would have to pay in case of an accident or damage to the rental car. For example, if the excess amount is $2,000 and you purchase excess insurance for $20 a day, your excess amount would be reduced to $0. If you decline excess insurance and the rental car is damaged, you’ll be responsible for paying the full excess amount.

Is Excess Insurance Necessary for Rental Car Coverage?

Whether or not excess insurance is necessary for rental car coverage depends on your personal situation. Here are some factors to consider:

- Your Personal Auto Insurance Policy: If you have a personal auto insurance policy, it may provide coverage for rental cars. Check with your insurance company to see if rental cars are covered and what the limits are. If your personal policy provides sufficient coverage, you may not need to purchase excess insurance.

- Your Credit Card Benefits: Some credit cards offer rental car insurance as a benefit. Check with your credit card company to see what type of coverage is provided and what the limits are. If your credit card provides sufficient coverage, you may not need to purchase excess insurance.

- The Rental Car Company: Some rental car companies require you to purchase excess insurance or provide proof of coverage. Check with the rental car company to see what their requirements are.

- Your Personal Risk Tolerance: If you’re comfortable with the risk of paying the excess amount in case of an accident or damage to the rental car, you may not need to purchase excess insurance. However, if you want to reduce your risk and have peace of mind, excess insurance may be worth the cost.

As we come to the end of our discussion on Sixt insurance, I want to leave you with one final tip. When choosing insurance for your rental car, make sure to read the terms and conditions carefully. This will help you understand exactly what is covered and what is not, so you can make an informed decision and avoid any surprises down the road.

At the end of the day, having insurance for your rental car is essential for your peace of mind and financial protection. With Sixt insurance, you can enjoy your travels without worrying about the unexpected.

Thank you for taking the time to read this article. I hope you found it informative and helpful. If you have any further questions or concerns, don’t hesitate to reach out to your insurance provider for more information. Safe travels!

If you found this article informative and engaging, be sure to visit our Auto insurance section for more insightful articles like this one. Whether you’re a seasoned insurance enthusiast or just beginning to delve into the topic, there’s always something new to discover in topbrokerstrade.com. See you there!