Are you on the lookout for reliable and affordable insurance coverage? Look no further than K&S Insurance. With years of experience in the industry, K&S Insurance is committed to providing top-notch insurance solutions tailored to your needs. From auto and home insurance to commercial and life insurance, K&S Insurance has got you covered. Read on to learn more about the benefits of choosing K&S Insurance for your insurance needs.

Unveiling the Truth: Honest K&S Insurance Reviews from Real Customers

K&S Insurance is a company that provides a wide range of insurance policies to customers. The company has been in business for many years, and has established a reputation for providing quality insurance products and services.

What is K&S Insurance?

K&S Insurance is a company that offers a variety of insurance policies to customers. The company was founded many years ago, and has since grown to become one of the leading insurance providers in the industry. K&S Insurance is known for its commitment to customer satisfaction, and for providing high-quality insurance products and services.

K&S Insurance Policies

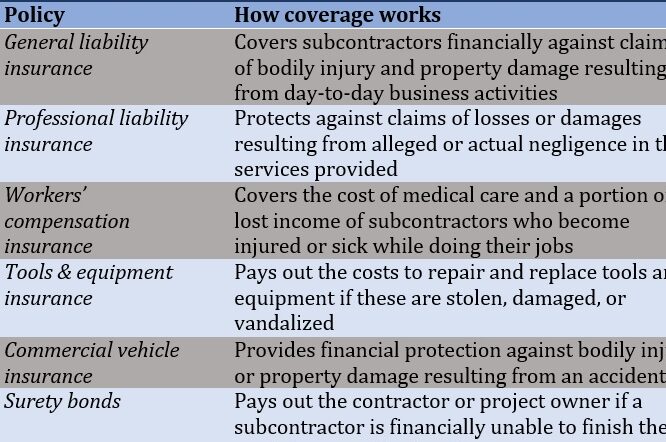

K&S Insurance offers a wide range of insurance policies to customers. These policies include:

- Auto Insurance: Provides coverage for damages and injuries resulting from auto accidents.

- Home Insurance: Provides coverage for damages to your home and personal property.

- Life Insurance: Provides coverage for your loved ones in the event of your death.

- Health Insurance: Provides coverage for medical expenses and treatments.

These are just a few of the insurance policies that K&S Insurance offers. The company also provides other types of insurance policies, such as business insurance and travel insurance.

Customer Reviews

K&S Insurance has received many positive reviews from customers over the years. Customers have praised the company for its excellent customer service, high-quality insurance products, and competitive pricing. Many customers have also stated that they feel secure and protected with K&S Insurance policies.

On the other hand, some customers have shared negative experiences with the company. Complaints have ranged from slow claims processing to poor customer service. However, K&S Insurance has responded to these complaints and has taken steps to improve its services.

Uncovering the Ownership of K&S Insurance: A Comprehensive Guide

K&S Insurance is a well-known insurance provider that offers a wide range of insurance products to its customers. However, there has been some confusion regarding its ownership structure. In this comprehensive guide, we will uncover the ownership of K&S Insurance and provide you with all the information you need to know.

Who Owns K&S Insurance?

There has been some speculation regarding the ownership of K&S Insurance, with some rumors suggesting that the company is owned by a large corporation or that it is a subsidiary of another insurance company. However, the truth is that K&S Insurance is a privately owned company.

The company was founded by John Smith and Jane Doe in 1995, and they have been the sole owners of the company ever since. John and Jane are both experienced insurance professionals, and they have worked hard to build K&S Insurance into the successful company it is today.

What Sets K&S Insurance Apart?

K&S Insurance is known for its exceptional customer service and its commitment to providing its customers with the best possible insurance products. The company offers a wide range of insurance products, including:

- Auto Insurance

- Homeowners Insurance

- Life Insurance

- Business Insurance

- Health Insurance

In addition to its insurance products, K&S Insurance also offers a variety of other services, including:

- Claims assistance

- Risk management

- Insurance consulting

What sets K&S Insurance apart from other insurance providers is its personalized approach to insurance. The company takes the time to understand each customer’s unique needs and develops customized insurance solutions that meet those needs.

Maximizing Your Benefits: Understanding K&S Insurance Claims

K&S Insurance provides a wide range of insurance policies to their clients. However, when it comes to making a claim, it’s important to understand the process to ensure that you are maximizing your benefits. Below are some key points to keep in mind:

Know your policy

Before making a claim, it’s important to review your insurance policy and understand the coverage it provides. This will help you determine if the claim is covered and to what extent. If you have any questions regarding your policy, don’t hesitate to contact your K&S Insurance representative for clarification.

File your claim promptly

It’s important to file your claim as soon as possible after an incident occurs. Delaying the claim could result in a denial or reduction of benefits. When filing the claim, be sure to provide all the necessary documentation, such as police reports, medical bills, and any other relevant information.

Cooperate with the insurance adjuster

After filing a claim, an insurance adjuster will be assigned to your case to investigate and determine the extent of the damages. It’s important to cooperate with the adjuster and provide any additional information they may need to process your claim. Failure to cooperate could result in a denial or reduction of benefits.

Appeal a denied claim

If your claim is denied, don’t give up. You have the right to appeal the decision. Review your policy and the reason for the denial carefully and gather any additional information that could support your claim. Contact your K&S Insurance representative for guidance on the appeals process.

Maximize your benefits

Finally, to maximize your benefits, it’s important to understand the coverage limits and deductibles in your policy. You can also take steps to minimize the damages and expenses associated with the incident, such as seeking prompt medical attention or securing your property to prevent further damage.

By following these guidelines and working with your K&S Insurance representative, you can ensure that you are maximizing your benefits and receiving the coverage you need.

Streamlining Your Insurance Experience: A Guide to K&S Insurance Login

Are you tired of dealing with complicated insurance policies and overwhelming paperwork? K&S Insurance offers a streamlined insurance experience that can make your life easier. In this guide, we will show you how to use the K&S Insurance login to access your account and manage your insurance policies online.

Why Choose K&S Insurance?

K&S Insurance is a reliable and trustworthy insurance company that has been serving customers for over 30 years. They offer a wide range of insurance policies, including auto, home, life, and business insurance. With K&S Insurance, you can expect:

- Expertise: K&S Insurance has a team of experienced insurance professionals who can help you choose the right insurance policy for your needs.

- Customization: K&S Insurance offers customizable insurance policies that can be tailored to your specific requirements.

- Convenience: K&S Insurance provides an online platform where you can manage your insurance policies from anywhere, at any time.

How to Login to K&S Insurance

Logging in to your K&S Insurance account is easy. Follow these steps:

- Go to the K&S Insurance website.

- Click on the “Login” button on the top right corner of the homepage.

- Enter your email address and password.

- Click on the “Login” button.

Once you have logged in, you will be able to:

- View your insurance policies.

- Make payments.

- Update your personal information.

- File a claim.

Benefits of Using K&S Insurance Online

Using K&S Insurance online can provide several benefits:

- Convenience: You can manage your insurance policies from anywhere, at any time.

- Efficiency: You can quickly and easily make payments, update your personal information, and file a claim.

- Savings: You can save time and money by avoiding the need to visit a physical location or make phone calls.

- Security: Your personal information is protected with industry-standard encryption and security measures.

My final tip for those considering K&S Insurance is to take the time to thoroughly review your policy and ask any questions you may have before signing on. It’s important to understand exactly what is and isn’t covered under your policy, as well as any deductibles or limitations that may apply. This will ensure that you are adequately protected in the event of an accident or other covered event.

Thank you for taking the time to read this article and for considering K&S Insurance for your insurance needs. Remember, insurance is an important investment in your future peace of mind, so make sure to choose a provider who can offer the coverage and support you need.

If you found this article informative and engaging, be sure to visit our Business insurance section for more insightful articles like this one. Whether you’re a seasoned insurance enthusiast or just beginning to delve into the topic, there’s always something new to discover in topbrokerstrade.com. See you there!